Africa is reputed to be a mobile-first market, with mobile-based solutions improving access to more services for more people, across both rural and urban Africa. Never before has this been more true. Today, mobile combines with innovative business and payment models to make an extensive range of products and services available universally across the continent – improving inclusion and fuelling economies.

Kenyan solar power provider M-KOPA Solar is a pioneer in applying innovative mobile-powered payment models to the solar energy market, with a view to expand access to sustainable power across rural Africa.

M-KOPA has a solar home system that consists of a solar panel, lights, torch, USB-based phone-charging unit and a radio. Customers pay daily micro-instalments and, by the end of one year, own the solar home system outright.

Once they own their home system, customers can then start paying for additional products, such as a digital TV, smartphone, water tank or cookstove, through the same payment model. Payment can only be made via mobile money – in Kenya, using the popular M-Pesa service. In Tanzania and Uganda, the company accepts mobile-money payments from multiple providers.

According to Jesse Moore, CEO and co-founder of M-KOPA, the pay-as-you-go payment model, combined with mobile money-based payments, provides the most effective way of providing an affordable service to rural consumers.

Through pay-as-you-go micro-payments, consumers are provided with a manageable route to accessing services and products that had thus far been out of reach, due to cost.

‘Most M-KOPA homes are low income, with per capita income of less than US$2 per day. They are looking for products and services that encompass affordability, dignity, convenience and advancement. We’ve learnt that any product we bring to the market has got to meet these criteria,’ says Moore.

He adds that users are likely to adopt new, sustainable power solutions – such as solar – as long as they see a direct correlation between it and what they spend on traditional fuel sources, most often kerosene. If they can pay the same amount or less – and the new solution promises an improvement on their current situation – chances are they will opt for the more sustainable option.

‘Our customer’s lives are transformed by PAYG [pay-as-you-go] power. They are healthier, wealthier and more connected. And with us, they can see that they have an affordable mechanism to access improved services. They can take that 50c that they were spending on kerosene every day and use it to upgrade to all sorts of services that were previously out of reach,’ says Moore.

‘Our solar TVs are a great example of this. Thousands of homes never thought they’d be able to afford a TV and power connection. Now they can – thanks to PAYG.’

Moore maintains that the pay-as-you-go mobile money-based model often leads customers into a world of more ‘luxury’ items too. Once they experience the success of easily paying off their home system, they are keen to add new ‘luxury’ items – such as smartphones and TVs – to their home.

‘For low-income African homes, the issue has often been about access to credit and power,’ he says.

‘This has locked them out of items that were once seen as luxury, but are now heavily commoditised. Our customers buy in to us making supposed luxury items available to them – often for the first time.’

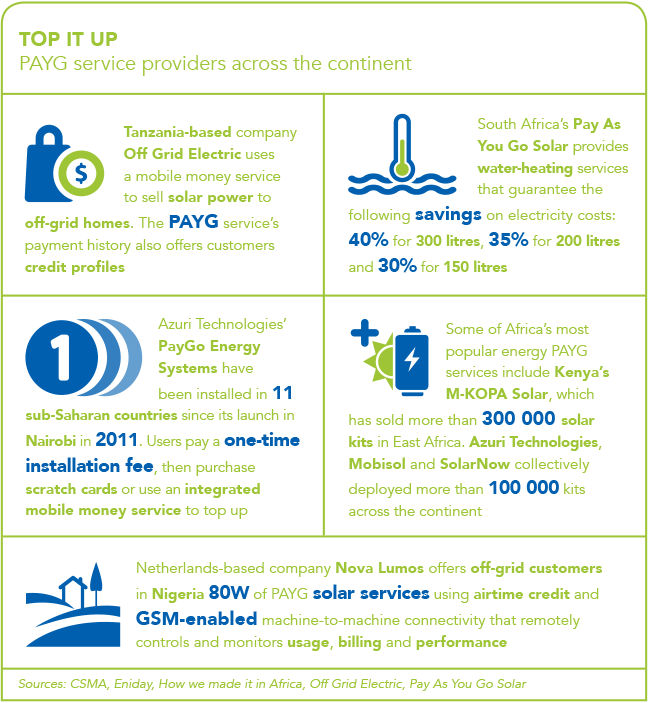

The mobile-enabled pay-as-you-go model is central to a number of power solutions found in Africa.

SteamaCo provides a metering solution for off-grid power providers that eases the challenge of payment collection in rural areas. The company’s smart meters process payments and switch power lines on and off in real-time. This eliminates the need for power providers to install meters, despatch technicians (to read the meters) and collect payments themselves.

From the customer’s perspective, they can buy power units by topping up their account via a mobile phone. When the account runs low, customers receive an SMS alert, and if the credits run out, the power line is cut automatically. However, it is reconnected as soon as the account is topped up. In this way, the pay-as-you-go model turns energy into an on-demand mobile service exactly like topping up airtime – while removing the need for the provider to monitor defaulting accounts.

Co-founder and chief technology officer of SteamaCo, Sam Duby, says the pay-as-you-go mobile money model – for the first time – allows rural consumers the same control over their access to energy as those in urban areas.

‘People can’t afford to buy a lifetime’s worth of energy in one go by paying the upfront costs of a solar set-up. Using the SteamaCo system, customers pay only for what they need, when they need it. The power delivered to them is of the highest quality and sufficient to run their homes as well as their businesses,’ he says.

‘It means that they don’t need to worry about system maintenance or buying the right technology – they can simply use productive power in the same way as their urban counterparts. This is made possible by the technology and financial inclusion revolution that is mobile money.’

The mobile money-fuelled model offers people access to energy, he says, and also enables them to enjoy a wide range of additional products and services, receive improved education and develop their businesses. Duby considers innovative power models as a stepping stone that will lead to overall economic growth. ‘The continent-wide penetration of mobile phone technology planted a seed. This is now blossoming into countless innovative business models and social interventions that are improving access to education, financial inclusion, agricultural data flow, access to energy, political engagement and countless others. The opportunities for economic growth that this unlocks are breathtaking.

‘Access to energy is considered a prerequisite for development but it doesn’t stop there. Once basic energy needs are met, what other innovations can these platforms enable to really accelerate change and rural development?’ says Duby.

Aside from the off-grid consumer-facing uses of innovative payments solutions, a number of companies are also leveraging alternative mobile payment solutions to spur the informal retail sector.

South African company Nomanini provides a range of mobile payment solutions for merchants operating in an informal setting – enabling them to process small denomination transactions and offer a variety of add-on services such as mobile top ups, power bill payments, cash-in and cash-out for mobile money, and other locally relevant payments. Nomanini’s solutions range from a smartphone application to handheld payment terminals.

According to Vahid Monadjem, Nomanini CEO, targeting retail merchants in informal settings is key to expanding financial and service-based inclusion in rural areas. ‘We view retail merchants as pivotal actors for financial inclusion for low-income people. We focus on building solutions for informal retail merchants to provide access to financial services in their local community,’ he says.

While there is a high prevalence of mobile money used in informal retail, Monadjem argues that cash is still very much in use, and as such it is important to provide channels for low-income cash-based consumers to use their funds to access the services they want. For this reason, providing innovative payment solutions for merchants is fundamental to improving access to services in rural areas.

‘More and more services are being paid for from electronic wallets, but physical retail purchases in Africa are overwhelmingly cash-based. As more consumer wallets become prevalent and used, so too must acceptance be enabled.’

Nonetheless, says Monadjem, mobile solutions are ‘here to stay’, and will increasingly be the basis of transactions across various sectors – from access to information to banking and insurance. As such, they will continue to impact and grow economies across Africa.