South Africa is open for business. Taking on the role of chief marketing officer, President Cyril Ramaphosa stands in front of his shop – the Republic of South Africa – proudly promoting its goods and services. The balance sheet may be suffering as a direct result of the global COVID-19 pandemic and subsequent lockdowns, but the shop still has much to offer. It’s a sophisticated department store among the continent’s many spaza shops.

The president and his team of ‘special investment envoys’ have been wooing foreign investors, highlighting selling points such as the country’s well-stocked shelves (South Africa is by far the continent’s most diversified economy) and its established support structures behind the shop front (notably the world-class infrastructure, advanced telecoms systems and well-regulated financial sector). And don’t forget the young population, which is desperate for training and employment in the shop that is South Africa.

Ramaphosa’s investment drive has taken him to market South Africa abroad, speaking to business leaders and high-profile audiences that have included heads of state at the World Economic Forum in Davos, Switzerland.

‘FDI [foreign direct investment] is of the utmost importance, as the country needs investment to stimulate economic growth,’ says Jannie Rossouw, interim director of Wits Business School. He adds that the government should court its traditional trading partners to attract more FDI.

South Africa also needs foreign money to cover its large budget and current account deficits, according to Reuters, which says: ‘Treasury data showed that foreign investors held 36.9% of South African government bonds as of October [2019].’

The president has made attracting investments a priority, boldly setting a target of US$100 billion (ZAR1.2 trillion) by 2023. He made this announcement at the first South Africa Investment Conference in November 2018, and summed up his fundraising achievements exactly a year later, during the 2019 conference. Speaking in front of business leaders from 23 countries, he said: ‘Local and international investors responded to our call and stood on this platform to make investment announcements totalling nearly ZAR300 billion. Of the 31 projects announced last year, eight projects have been realised and completed. Seventeen are in construction or at implementation stage. In total, this represents ZAR238 billion of the investments that were announced last year.’

Many of those that pledged investments are mining companies, for example Vedanta (set to invest ZAR21.4 billion, according to Fin24), Anglo American (ZAR71.5 billion), Ivanplats (ZAR4.5 billion) and Bushveld Minerals (ZAR2.5 billion). Another priority sector is car manufacturing – multinationals such as Mercedes-Benz are making substantial investments and, in January 2020, Toyota announced it would invest ZAR4.28 billion in its parts distribution and manufacturing operations in South Africa, creating up to 1 500 local jobs.

Other investors, Fin24 reports, include home-grown South African companies Sappi (ZAR7.7 billion), Mondi SA (ZAR8 billion), Rain (ZAR1 billion) and Naspers (ZAR6 billion), as well as the Rwanda-based Mara Group, which recently opened a ZAR1.5 billion smartphone manufacturing facility in KwaZulu-Natal.

The government is casting its net further, seeking investors outside the traditional trading partnerships that historically include the US, Europe, the UK and, more recently, China. Focus has shifted to the Middle East and Africa (‘from Nairobi to Lagos and from Dakar to Cairo’), where the African Continental Free Trade Agreement is expected to encourage intra-continental investments.

In July 2018, Ramaphosa and his delegation travelled to the Middle East, where they secured US$10 billion from the UAE and another US$10 billion from Saudi Arabia. The latter has also expressed interest in leasing farmland from South Africa to grow agricultural produce for export. According to the Brookings Institute, Saudi Arabia has become the top investor in agriculture in Africa in its quest for food security.

South African Finance Minister Tito Mboweni said ahead of the WEF meeting in Davos that the country’s FDI had risen sharply in 2018 to ZAR70.6 billion, from ZAR26.8 billion in 2017. ‘The positive momentum continued in the first semester of 2019, considering strong inflows valued at ZAR38 billion,’ he said, adding that the second South Africa Investment Conference attracted investment pledges of ZAR363 billion.

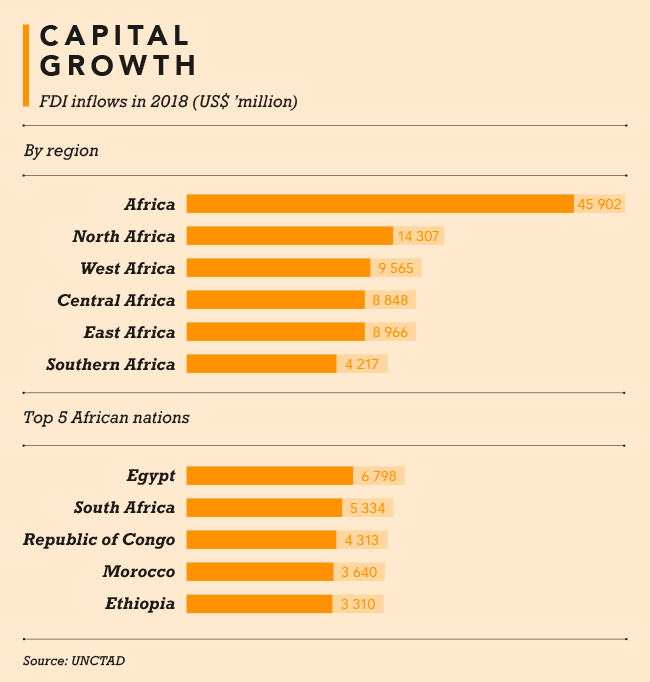

According to the UN Conference on Trade and Development (UNCTAD) 2019 World Investment report, FDI flows into South Africa increased by 165% in 2018, reaching US$5.3 billion. However, this large increase is mainly due to ‘intra-company transfers by established investors’.

While any FDI is welcome, Raymond Parsons, economics professor at the North West University Business School, explains that some types of investment are more welcome than others. ‘We know the benefits of FDI extend well beyond attracting needed capital for a country like South Africa. Foreign investment also confers technical know-how, managerial and organisational skills and access to foreign markets, which is the kind of FDI that South Africa needs,’ he says.

The South African Institute of International Affairs, an public-policy think tank, says there are four types of FDI: greenfield (new investment with relatively substantial inflows of FDI, new production capacity and employment); brownfield (into an existing facility geared towards improving or increasing its capacity, with a quick technology and skills spillover effect); mergers and acquisitions (inflow of FDI capital but not necessarily new productive capacity); and joint ventures (a strategic alliance between a foreign and, usually, local company).

Parsons says that ‘intra-company transfers by established investors [as South Africa’s latest FDI inflows are described by UNCTAD] are fine, but second prize in FDI terms’. He explains what should be done to attract the type of ‘first prize’ FDI. ‘In general, investors consider a broad range of factors in deciding to invest in a country like South Africa, the most important being political stability and security, as well as a business-friendly legal and regulatory environment.

‘Given South Africa’s current economic challenges, we need to have an acute grasp of the new policies, pro-growth reforms and economic restructuring now required to maximise FDI flows, including the overwhelming need for security of power supply to business operations in this country. The Eskom saga is widely regarded, including by government, as the single most serious obstacle to large-scale new investment in South Africa.’

It doesn’t help that the three major ratings agencies have downgraded South Africa’s credit rating to sub-investment grade. ‘We cannot really expect foreign investors to display more confidence in SA than domestic investors have in SA’s economic prospects,’ according to Parsons.‘The reality is that business confidence has to radiate out from SA based, on a strong collaborative and trusting relationship between business and government. President Ramaphosa rightly wants to see South Africa rise in the World Bank’s Ease of Doing Business Ranking to below 50 within the next few years.’

Despite all efforts, South Africa slipped from 82nd to 84th out of 190 countries in the latest ranking. It’s a far cry from 2008 when SA came 32nd – its best ranking so far. Mauritius (placed 13th) and Rwanda (38th) are the only sub-Saharan African countries in the top 50 regarding ease of doing business.

On the upside, South Africa improved slightly in another international ranking, gaining seven places (from 67th to 60th) out of 141 in the 2019 WEF Global Competitiveness Index.

Rossouw says that in order to attract FDI, the network industries (transport, energy, water and communications) must work, and government approvals of initiatives must be expedited. ‘At the same time, investors must have confidence that their investments will be safe in South Africa and will not be expropriated without compensation,’ he says.

In addition to addressing policy uncertainty, the government should commit to policies that enable ‘economic dynamism’, says Martyn Davies, MD of emerging markets and Africa at Deloitte. FDI should be channelled to start-ups, small businesses, and low-income regions with high levels of unemployment, he said after the 2018 South Africa Investment Conference. ‘The state needs to become the entrepreneur in the same way as Asian states have underwritten the incredible economic development of their societies.’

To this extent, Ramaphosa has established special economic zones in strategic locations that offer tax and customs incentives for investors to transfer skills, boost SMEs and grow the local economy. The Department of Trade and Industry is also rolling out the InvestSA One Stop Shop initiative, single contact points to reduce red tape and help investors with licensing and regulatory issues.

The InvestSA website lists the latest foreign and local investment announcements, together with 10 reasons to invest in the country. For those who haven’t heard it yet, there is the overarching message: ‘South Africa is open for investment’.