Since its launch in 2014, Grit Real Estate Income Group has managed to attract an impressive number of investors and partners, with a winning strategy. Following its introduction to the Stock Exchange of Mauritius and the Johannesburg Stock Exchange, Grit has reached new heights by becoming the first Mauritian-based company to be registered on the Main Board of the London Stock Exchange. The CEO and co-founder, Bronwyn Corbett, reveals the strengths that make Grit a trusted and indispensable partner in the real estate industry.

Q: You have recently been registered on the London Stock Exchange (LSE). Tell us more about your business and what attracted you to the bourse.

A: Our listing on the main market of the London Stock Exchange represents a step-change in the business that will position the company for significant growth and exposure. The capital raised from the LSE listing will enable our entry into new African territories and consolidate our presence in existing jurisdictions. It will also improve the depth and diversity of our shareholder base, and improve the liquidity of the stock, resulting in the inclusion in varied indexes – specifically the FTSE Frontier Index and MSCI Frontier Index. We are proud to bring our passion and vision for Africa to London.

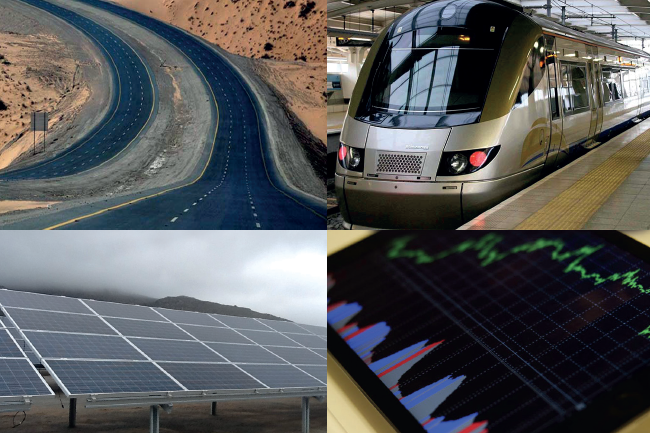

Grit launched in July 2014 and is the largest pan-African listed real estate company offering investors direct exposure to attractive and sustainable hard currency income streams underpinned by prime real estate assets and long leases to blue-chip international and national tenants. Our focus is on selected African countries with solid fundamentals and high-growth opportunities. We currently operate in seven countries on the continent, including Kenya, Morocco, Mozambique, Zambia, Mauritius, Botswana and Ghana.

As a result, Grit is unbiased as far as real estate asset classes are concerned. We evaluate risk based on tenant strength, in addition to country and property fundamentals, such as the economic growth rate, location and nodal development.

This means we will acquire and hold assets across the spectrum, including commercial offices, retail centres, corporate accommodation, hospitality, light industrial warehousing and logistics centres, provided that it ticks the boxes from a fundamental perspective (right node, right quality, right price and so on), and that a long lease with a reputable international tenant is in place.

Q: Why expand into the rest of Africa when most of your listed, South African counterparts have tapped into Eastern Europe? What attracts you to these markets and how do you identify targeted jurisdictions?

A: We originally considered various options but something we kept coming back to was our passion for the continent. It’s no coincidence that the company is named Grit because unless you have infinite passion, perseverance and believe in what you are doing, the challenges will very quickly wear you down. We knew that our knowledge, networks and belief in the African growth story is our biggest differentiator and something competitors will not easily replicate.

Collectively, the four senior members of our executive team have more than 65 years of property experience on the continent.

Although each country presents a different investment thesis, we apply several considerations as standard practice when looking at expansion opportunities. These margins of safety include the ability to earn and repatriate hard currency; political and macroeconomic stability; land tenure; and the ability to raise debt.

In addition to this, the strength of the tenant plays a critical role as some of our leases are underwritten by the international parent company.

Q: Tell us more about your recent acquisitions and pipeline transactions.

A: Ghana was, some time ago, earmarked as an expansion country, based on its strong fundamentals. We have been monitoring Ghana’s economic reform with interest since 2014. The real estate market repriced sufficiently for us to expand our portfolio with the acquisition of 5th Avenue Corporate Offices, a three-storey, fully let 5 070 m2 GLA A-grade office complex in the upmarket Cantonments quarter of the capital, Accra.

There is a strong political will to implement REIT legislation in Ghana, which will allow further tax-efficient structuring as well as access to local capital looking for a unique investment offering.

Post the London Stock Exchange listing, we will conclude a number of agreements that have been signed or are in advanced discussions for an additional three commercial buildings in Accra as well as a corporate accommodation asset in Mozambique under-pinned by us.

Q: What potential do you see in sub-Saharan Africa for future growth for the company?

A: A fairly recent study by the Economist Intelligence Unit found that institutional investors now regard the emergence of Africa’s middle class and its growing consumerism – rather than its commodities –as the most attractive aspect of investing in the continent.

Using the theory of purchasing power parity (an economic concept used to determine the relative value of different currencies) and considering the relative prices of non-tradable goods in different countries, Africa is estimated to grow by 30% over the next five years, compared to 10% in other more developed regions.

PwC, in a 2015 report titled Real Estate: Building the Future of Africa, noted that Africa’s retail market is fast developing. This is supported by the continent’s buying strength, which is expected to increase from US$860 million in 2008 to US$1.4 trillion by 2020. Our real estate strategy will be defined by the needs of the African people and the required presence for international corporates on the continent.

Q: What will shape real estate on the African continent over the next 30 years?

A: The largest opportunity also poses the largest threat: rapid population growth will require infrastructure and nodal development apace, necessitating collaboration – not only through public-private-partnerships but also between developers, landlords, tenants and especially, providers of capital. This means real estate opportunities will vary from country to country, and node to node.

In Nairobi, for example, logistics and warehousing assets are outperforming other asset classes by some margin.

Our experience in Zambia has demonstrated that large convenience retail centres in rural areas outperform urban regional shopping centres that have a more traditional mix of luxury and entertainment.

From Grit’s perspective, we will continue to partner with our tenants to provide appropriate accommodation that’s the right fit for them, regardless of asset class.

Q: What potential is there for future retail developments in sub-Saharan Africa, excluding South Africa? Is the market largely untapped, or do you think enough headway has already been made to make the market open and responsive?

A: Significant construction activities in respect of shopping malls are under way in Africa. In Lagos, 10 were under construction at the time PwC released its aforementioned report.

More than 60% of sub-Saharan Africa’s bullish economic growth is attributable to the region’s consumer spending, and most of the world’s biggest consumer goods companies are already operating in Africa. An analysis of major South African retailers expanding into Africa showed that growth in turnover of their African operations were often three times more than in South Africa.

As mentioned earlier, real estate on the continent is still in its infancy. Developers have also learnt that Africa is not a ‘one-size-fits-all’ destination, and what works from a retail perspective in one country won’t necessarily work in another.

Looking ahead, we expect to see rapid growth in both depth and sophistication, especially as regulatory changes and the introduction of REIT status stimulate investments into the asset class.